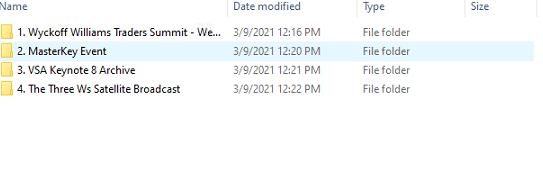

[Download] Complete Wyckoff VSA Course Collection

$50.50

- Delivery: You Will Receive A Receipt With Download Link Through Email.

- Why its cheap? Click here

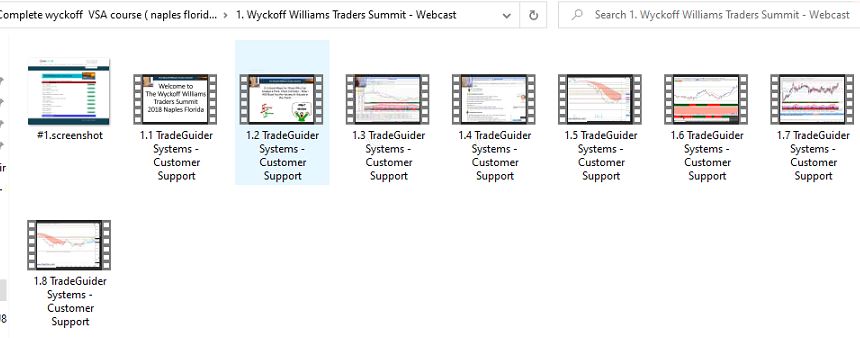

Proof of course:

A unique collection of 4 courses provide over 60 hours of educational content , seminar conducted by renowned traders in naples , Florida )

Everything you need to know to trade the markets using Wyckoff method & volume spread analysis .It is the system the professional trading community uses and it’s the system they don’t want you to know about!

The courses are structured and understandable content will bring you the confidence, knowledge, principles and

structure to your trading activity.

Course 1

Session 1: How why and when markets move

- Why Volume is so important

- Supply and Demand

- Accumulation and Distribution

- Price action

Session 2: Volume; the key to reading the markets

- Top 3 ways to predict a market turn to the upside

- Top 3 ways to confirm a market turn to the upside

- Top 3 ways to predict a market turn to the downside

- Top 3 ways to confirm a market turn to the downside

Session 3: Market Trends

- Trend analysis

- The trading playing field

- Multiple time-frame analysis

- Support and resistance

- Session 4:Putting it all together

- Building a trading plan

- Trade management techniques

Session 5: Presenting a rules-based strategy for trading with the trend

- Scan for trend alignment

- Identify a confirmation sign

- Trade Entry Trade exit

Session 6: Live-trading the rules-based strategy for trading with the trend

- This session focuses on Trend trading techniques in a live trading environment.

- In the first of our trading sessions the team took live trades. As they traded they answered questions and provided guidance on entry points, trade management and optimal exit points.

Session 7: Presenting a rules-based strategy for counter-trend trading

- Identify Market tops and bottoms

- Identify a confirmation sign

- Trade entryTrade exit

Session 8: Live-trading the rules-based strategy for counter-trend trading

- This session focuses on Counter-trend trading techniques in a live trading environment.

- In the second of our live trading sessions the team took live trades. As they traded they answered questions and provided guidance on entry points, trade management and optimal exit points.

COURSE 2 – The MasterKey Trading Strategy Event

This event detailed advanced next generation, rules-based strategies for trading the markets using Volume Spread Analysis.

Day 1: The 8 Key Factors which really determine trading success

- Understanding the importance of Volume and how to read it

- Managing risk

- Knowing what moves markets, how and why

- Having a plan and approach which works for you

- Having a strategy for using time-frames

- Knowing when to enter and why

- Understanding and appreciating trends

- Understanding when to exit and why

The 2nd day will covered the following aspects:

- Advanced Masterkey scanning techniques for different trading styles

- Innovative Masterkey trade management techniques

- Techniques for reading and understanding confirmation signals

- Advanced charting techniques

- Advanced methods for determining entry points

- Masterkey strategy for defining optimum exit points

- Live trading with real money

- Developing the optimum trading mindset

COURSE 3 – VSA Keynote 8

What the event covered:

- Advanced scanning techniques

- Advanced Confirmation Strategies and Chart Construction

- Point & Figure MasterClass

- The Power of Belief

- Detailed Trade Set Ups

- Capital preservation

- Advanced option trading strategies

- Creating a long-term Investing Strategy

COURSE 4 – The Wyckoff Williams Traders Summit

See a world class team of experts for a unique educational experience and discover how tried, tested and trusted methodologies developed over a century ago have survived, flourished and emerged as the proven solution to the trading problems of the modern, turbulent, manipulated markets of today.

12 hours of trading and analysis with Wyckoff VSA methodology

Introduction from the Master with Tom Williams

Veteran Syndicate trader and inventor of VSA will host the first session where he will present his take on the week’s trading ahead and also what he thinks the market will perform longer term. His unique insight into the markets is a great way to start day 1. There will be opportunity at the end for you to put questions to the Master.

What does it take to be a Smart Trader? Opening presentation with Gavin Holmes

Gavin will identify the 6 essential requirements for becoming a “Smart Trader”. He will explain why the requirements are so important and and how, during this weekend’s course, you will learn how to ensure you meet these requirements.

VSA Principles Explained Part 1 – Philip Friston

VSA Expert and UK Fund Manager Philip Friston will explain how the key VSA Principles to the long side work, how you identify them, what you then look for confirmation and then when you would enter the trade. The principles will include Bag Holding, Tests, Stopping Volume, Shakeouts and Pushing up through Supply. Each principle will be explained with numerous chart examples.

VSA Principles Explained Part 2 – Philip Friston

In this second session Philip Friston will explain how the key VSA Principles to the short side work, how you identify them, what you then look for to confirm and when you would enter the trade. The principles will include End of a Rising Market, No Demand, Upthrust, Buying Climax and High Volume on Up-bars. Each principle will be explained with numerous chart examples.

Chart Reading Mastery – Session 1 Gavin Holmes & Philip Friston

In this session the VSA principles featured in Philip’s earlier presentation are used to build VSA Sequences in this live chart analysis session at the right edge of the market. You will discover:

How to trade using multiple time-frames

How to trade within the playing field

The use of pivot points, Fibonacci retracements

Some new sequences developed by Tom Williams that have not been revealed before

Introduction to Kagi Charts with Tom Williams and Gavin Holmes

In this session tom and Gavin cover the features ansd benefits of using Kagi Charts. They cover:

Definitions

How they are used and why

The main benefits of using Kagi charts

How they work with VSA

Using VSA with Market Geometry and Elliot Wave – Rafal Glinicki

Award winning professional trader Rafal Glinicki presents the final session showing how combining VSA with Elliot Wave and market geometry can increase the accuracy of your trading and keep you in the trade for much longer. 3 different market perspectives which complement each other to form a very powerful trading system. It is this system which will be at the heart of TradeGuider’s European Managed Funds due to launch next year.

Putting It Together with Lauren Snedeker – Session 1

In this first session Lauren will highlight the importance of having a trading plan. She will explain what’s involved and why. Lauren will outline thought processes you need to go through and then how to use the plan once you have built it. Finally Lauren will demomnstrate the process for keeping the plan fresh and relevant – not just to trading, but to all aspects of your life.

Putting It Together with Lauren Snedeker – Session 2

In Lauren’s second session you will actually build your own trading plan using the VSA Trading Plan template that is provided with the course.

By the end of this session you will have a Trading Plan which you can take home and use within your trading. This alone will transform the way you trade – giving you clarity, security and structure.

Trading Mindfully with Dr Gary Dayton

Mindfulness has become a potent technique in helping traders make important behavioral changes.

During the session Dr Gary will show you how to develop the skill of mindfulness as a way to enhance your trading performance and reduce stress. Mastering the skills of mindfulness can be of benefit in at least three significant ways:

Improved focus and concentration

Staying in the present

De-centering from thoughts and emotions.

Classic Wyckoff Point & Figure with Dr Gary Dayton

Wyckoff Point & Figure charts compliment the VSA methodology and during this presentation Wyckoff expert Dr Gary Dayton takes you through the main features and benefits of using this charting method alongside VSA.

Gary will mixx theory with real life chart examples

Trading the News with Gavin Holmes

Can you believe everything you see and read in the media? What’s the truth, where’s the spin? In this session Gavin Holmes will teach you how to trade alongside the media and use it to your advantage. He will show:

How the “Smart Money” uses the media to wrong-foot you

How you can use the media alongside Fundamental Analysis and VSA to really see what is going on.

The tricks the professionals use and how to spot them

5 step strategy for trading the news

Trading Strategies to Take Away with Rafal

In this session Gavin and Rafal present a selection of their favorite trading set ups with detailed examples. Covering literally every market and most styles they will build up an impressive group of trading set ups which you can take away and implement in your own trading.

They will feature VSA principles, Elliot Wave, Point & Figure, together with Market Geometry – all tools contained in the new VSA”Smart Money” tracker Add-in for Infinity AT \ sierra Chart. The software is provided free to delegates – you have lifetime ownership.

You will come away from the presentations with at least 3 high probability, low risk trading set ups to the long side and 3 to the short side.

Reviews

There are no reviews yet.